Breakeven is the point at which at profit is “ZERO”. It’s important for entity to know how much revenue to revue it has to earn to reach at point after passing which they are going to start earning profits. It helps entity in making important decisions adding to its profits. It makes life much easier for you if you that by selling certain number of units you can cover total costs and from now you can strive for profits, breakeven ratios are there to rescue in this area.

Break Even Point

Total Revenue – Total Cost = 0

Break Even Point(In $)

Fixed Cost / CS Ratio OR

Break Even Point * Selling Price

Break Even Point(Quantity)

Fixed Cost / Contribution per unit

Target profit

Target profit shows units entity must have to sold in order to earn certain profit called target profit. It helps entity to anticipate future targets keeping in mind breakeven

UNITS

Total Required Contribution (Fixed cost + Target profit) / Contribution per unit (Sale per unit – Variable cost per unit)

VALUES

Total Required Contribution (Fixed cost + Target profit) / C/M Ratio (Contribution Margin Ratio)

Contribution to sale ratio

Contribution= sale revenue less variable cost

FORMULA =Sales – variable cost

C/S ratio= Contribution per unit/ selling price per unit

OR

Total contribution/ total sale revenue

Margin of safety

Margin of safety guides entity regarding safety margin it has before getting losses. It is basically the difference between units sold and units at breakeven point, the resulting GAP shows the safety margin

Margin of Safety = Total Sales – Break even Sales

Margin of Safety ($) = Profit / CS Ratio

Margin of Safety (units) = Profit / Contribution per unit

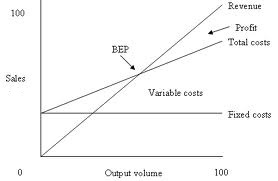

Breakeven Charts

Breakeven shows in graphical way the same picture as above formula. Graphical representation makes understanding of issues much easier.it helps to identify :

- Total cost

- Fixe cost

- Breakeven point

- Margin of safety

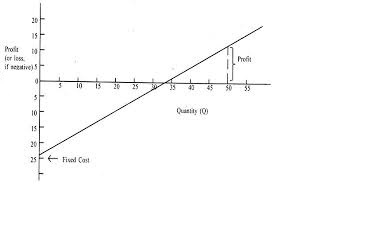

profit volume chart