COST CLASSIFICATION – TYPE OF COSTS

In any business or organization, costs are a fundamental aspect that requires careful management and strategic thinking. Cost classification is the process of categorizing these costs into meaningful groups, which helps in decision-making, budgeting, and evaluating the financial health of the entity. Proper cost classification enables managers and stakeholders to allocate resources efficiently, set prices, and plan for the future. This article will provide a comprehensive overview of the different types of costs, their characteristics, and how they impact businesses.

Introduction to Cost Classification

Cost classification is a systematic approach to organizing and categorizing the expenses incurred by a business. It involves grouping costs based on their common characteristics, behavior, or the purpose they serve within the organization. Well-defined cost classifications facilitate better cost control, enable accurate financial reporting, and provide valuable insights for managerial decision-making.

The study of cost classification is essential for several reasons. Firstly, it helps managers understand the cost structure of their business, allowing them to identify areas where costs can be reduced or optimized. Secondly, cost classification forms the basis for cost-volume-profit analysis, break-even analysis, and margin calculations, which are crucial for pricing decisions and profitability assessments. Lastly, proper cost classification improves transparency and accountability in financial reporting, making it easier for stakeholders to understand a company’s financial health and potential.

Types of Costs

Now, let’s delve into the various types of costs and explore their characteristics and implications for businesses:

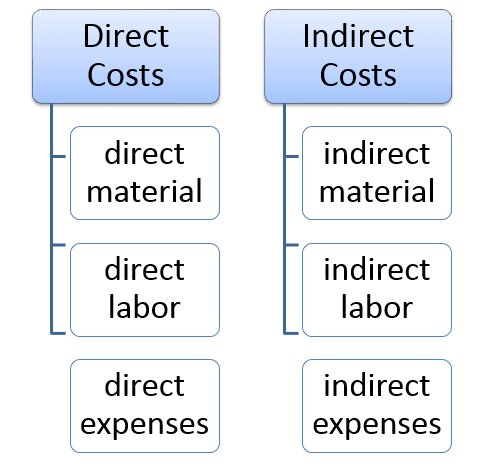

Direct Costs and Indirect Costs

Direct costs are those that can be easily and specifically identified with a particular cost object, such as a product, department, or project. These costs have a direct and traceable relationship with the cost object. Examples of direct costs include raw materials used in manufacturing, direct labor costs associated with producing a specific product, or advertising expenses for a particular marketing campaign. Direct costs are typically variable, meaning they change in proportion to the output or activity level.

Indirect costs, on the other hand, are costs that cannot be directly attributed to a specific cost object but are necessary for the overall operation of the business. These costs are shared across multiple cost objects or departments. Examples of indirect costs include rent, utilities, administrative salaries, and office supplies. Indirect costs are often fixed in nature, remaining relatively constant regardless of the output level.

Understanding the distinction between direct and indirect costs is crucial for cost allocation and product pricing. Direct costs are usually charged to a specific job or product, while indirect costs are allocated across multiple cost objects using various allocation bases, such as machine hours, square footage, or direct labor hours.

Fixed Costs and Variable Costs

Fixed costs are costs that remain constant over a specific period or within a relevant range of output. These costs do not vary with changes in production volume or sales activity. Fixed costs are incurred regardless of whether the business produces or sells anything. Examples of fixed costs include rent, insurance, salaries of permanent staff, depreciation on equipment, and administrative overhead.

Variable costs, in contrast, are costs that change in proportion to the level of output or sales activity. These costs increase or decrease depending on the volume of goods produced or services provided. Examples of variable costs include direct materials, sales commissions, shipping costs, and utilities that vary with production levels.

The distinction between fixed and variable costs is vital for break-even analysis, margin calculations, and decision-making. Fixed costs provide a baseline for understanding the minimum expenses a business must cover to remain operational. Variable costs, on the other hand, help determine the incremental costs associated with producing or selling one additional unit of output.

Operating Costs and Non-Operating Costs

Operating costs, also known as operating expenses or OPEX, are the day-to-day expenses incurred by a business in the normal course of its operations. These costs are directly related to the production, administration, or sale of goods and services. Operating costs include both direct and indirect expenses, such as raw materials, labor, utilities, advertising, rent, insurance, and office supplies. Operating costs are necessary for the ongoing functioning of the business and are typically recurring in nature.

Non-operating costs, on the other hand, are expenses that are not directly linked to the core operations of the business. These costs are usually one-off or non-recurring in nature and arise from external factors or financial activities. Examples of non-operating costs include interest expense on loans, gains or losses on the sale of assets, rental income from idle equipment, dividends received, or legal fees for a lawsuit.

Separating operating costs from non-operating costs is important for assessing the operational efficiency and profitability of a business. Operating costs provide insights into the day-to-day financial performance, while non-operating costs reflect the financial health and external influences on the business.

Product Costs and Period Costs

Product costs, also referred to as inventoriable costs, are the costs incurred in the process of acquiring or producing goods that are intended for sale. These costs are directly attributable to the creation of a product and are necessary for it to be sold. Product costs include direct materials, direct labor, and factory overhead. Direct materials refer to the raw materials or components used in the production process. Direct labor includes the wages paid to workers directly involved in manufacturing the product. Factory overhead covers indirect costs associated with the production process, such as rent for factory space, depreciation of machinery, and utilities for the factory.

Period costs, on the other hand, are expenses that are not directly linked to the production of goods but are necessary for the overall functioning and management of the business. These costs are incurred regardless of whether goods are produced or sold. Period costs are usually related to selling, administrative, or general expenses. Examples of period costs include advertising, sales commissions, office rent, executive salaries, accounting fees, and legal fees.

The distinction between product costs and period costs is important for inventory valuation and financial reporting. Product costs are included in the value of inventory, which flows through to the cost of goods sold when the inventory is sold. Period costs, on the other hand, are expensed directly in the period in which they are incurred and do not form part of inventory valuation.

Prime Costs and Conversion Costs

Prime costs represent the direct expenses associated with the production of a product. They consist of two main components: direct materials and direct labor. Direct materials refer to the raw materials or components that are physically incorporated into the final product. Direct labor includes the wages paid to workers directly involved in transforming raw materials into finished goods. Prime costs are considered the foundation of a product’s cost structure, as they represent the essential and unavoidable expenses in the production process.

Conversion costs, on the other hand, represent the expenses incurred to convert raw materials into finished goods. These costs include direct labor and manufacturing overhead. Manufacturing overhead covers all indirect costs associated with the production process, such as factory rent, depreciation of machinery, supervisor salaries, utilities for the factory, and maintenance expenses. Conversion costs are important in assessing the efficiency of the production process and the overall cost structure of a product.

Analyzing prime costs and conversion costs provides insights into the cost drivers of a product. Prime costs represent the variable costs of production, as they change in proportion to the volume of output. Conversion costs, on the other hand, may include both fixed and variable elements, depending on the nature of the manufacturing overhead costs.

Marginal Costs and Sunk Costs

Marginal costs refer to the incremental costs incurred by producing or acquiring one additional unit of output. In other words, it is the change in total cost resulting from a one-unit change in output. Marginal costs include only the variable costs associated with production, such as direct materials, direct labor, and variable overhead. Fixed costs are excluded from marginal costs because they do not change with fluctuations in output levels.

Marginal cost analysis is a critical tool for decision-making. It helps businesses determine the optimal production level, set prices, and evaluate the profitability of adding or dropping a product line. Marginal costs also play a significant role in short-run production decisions, as they indicate the additional costs of producing more or less in the short term.

Sunk costs, on the other hand, are past costs that have already been incurred and cannot be recovered or changed. These costs are irrelevant for future decision-making because they have already been spent and do not impact future cash flows. Examples of sunk costs include money spent on research and development, advertising campaigns that have already run, or equipment that has been purchased and cannot be returned.

It is important for businesses to distinguish between marginal costs and sunk costs when making decisions. Marginal costs provide valuable information about the costs of future actions, while sunk costs should be ignored since they cannot be recovered. By focusing on marginal costs, businesses can make more informed choices that optimize profitability and resource allocation.

Controllable Costs and Uncontrollable Costs

Controllable costs are expenses that can be influenced or managed by a specific individual or department within the organization. These costs are subject to the control and discretion of a particular manager or team. Examples of controllable costs include production quantities, inventory levels, advertising expenses, research and development spending, and employee overtime pay. Managers are typically held accountable for these costs and are expected to optimize them to achieve organizational goals.

Uncontrollable costs, as the name suggests, are costs that are beyond the control or influence of a particular manager or department. These costs are typically driven by external factors or higher-level strategic decisions. Examples of uncontrollable costs include taxes, interest rates, exchange rates, rent or lease agreements, insurance premiums, and utility rates. While these costs cannot be controlled, managers should still be aware of them and consider their impact on the overall financial performance of the business.

The distinction between controllable and uncontrollable costs is important for performance evaluation and accountability. Managers are assessed based on their ability to manage controllable costs effectively and efficiently. Controllable costs are also used as a basis for incentive systems, rewarding managers for achieving cost savings or meeting budgetary targets.

Avoidable Costs and Unavoidable Costs

Avoidable costs are expenses that can be eliminated or reduced by taking a particular course of action or making a specific decision. These costs are discretionary in nature, meaning they can be avoided if certain actions are taken. Examples of avoidable costs include advertising expenses, research and development spending, employee training costs, and maintenance expenses. By choosing to cut back on advertising or reducing research and development efforts, a business can avoid or reduce these costs.

Unavoidable costs, on the other hand, are expenses that must be incurred regardless of the decisions or actions taken by the business. These costs are inherent to the operation of the entity and cannot be avoided. Examples of unavoidable costs include fixed costs such as rent, insurance, salaries of permanent staff, depreciation, and interest on loans. Unavoidable costs are necessary for the ongoing functioning of the business and cannot be eliminated without impacting its ability to operate.

The concept of avoidable and unavoidable costs is particularly relevant in decision-making and cost-benefit analysis. By identifying avoidable costs, businesses can assess the potential savings or benefits associated with different alternatives. Unavoidable costs, on the other hand, provide a baseline for understanding the minimum expenses that must be incurred to keep the business running.

Opportunity Costs

Opportunity cost represents the potential benefit or value that is given up when one alternative is chosen over another. In other words, it is the cost of the next best alternative that was not chosen. Opportunity costs are not always reflected in financial statements or accounting records, but they are an important consideration in decision-making. They help businesses evaluate the trade-offs involved in different choices and assess the potential benefits forgone by pursuing a particular course of action.

For example, consider a company that has $100,000 to invest and must choose between two mutually exclusive projects. Project A is expected to generate a return of $15,000, while Project B is projected to yield a return of $20,000. In this case, the opportunity cost of choosing Project A is $5,000, which is the difference between the expected returns of the two projects. By selecting Project A, the company gives up the potential to earn an additional $5,000 by choosing Project B.

Understanding opportunity costs is crucial for making informed decisions and optimizing resource allocation. It helps businesses identify the true cost of their choices and consider the potential benefits that could have been realized by pursuing alternative options. Opportunity cost analysis encourages managers to think beyond just the financial implications and consider the broader implications of their decisions.

Conclusion

Cost classification is a powerful tool for businesses to gain a deeper understanding of their expenses and make more informed decisions. By categorizing costs into meaningful groups, managers can identify cost drivers, assess profitability, and optimize resource allocation. The various types of costs discussed in this article provide a framework for analyzing and managing expenses effectively.

Direct and indirect costs help allocate expenses to specific cost objects, while fixed and variable costs provide insights into the cost structure and break-even point. Operating and non-operating costs distinguish between day-to-day expenses and external financial influences. Product and period costs differentiate between inventoriable costs and expenses related to the overall functioning of the business. Prime and conversion costs break down the cost structure of a product, while marginal and sunk costs guide decision-making by focusing on incremental costs and irrelevant past expenses, respectively. Controllable and uncontrollable costs establish accountability, and avoidable and unavoidable costs highlight the potential for cost savings. Lastly, opportunity costs encourage managers to consider the trade-offs and potential benefits forgone in their decisions.

By mastering cost classification and understanding the nuances of each cost type, businesses can improve financial management, enhance profitability, and make more strategic choices. Cost classification forms the foundation for effective cost control, budgeting, and financial planning, ultimately contributing to the long-term success and sustainability of the organization.

SUMMARY:

Cost classification is arranged in groups on suitable basis. Costs can be classified on different basis:

- Element

- Function

- Nature

Classification on basis of Element

- Material –materials purchase for production or non- production purpose, direct or in direct material

- Labor – all salaries and wages paid to workforce whether work specifically for materials as direct labor costs or indirect labor like supervisor salary

- Overhead – expenses other than material and labor

Classification on basis of Nature

- Direct Costs – Cost that can be attributed to a specific cost unit. In other words cost that form essential part of final product e.g material for specific product, labor specifically working on certain product will become part of that product

- Indirect costs – Cost that cannot be attributed to a specific cost unit or costs that are not part of any specific product like salary cost of supervisor, rent and depreciation expenses

Classification on basis of Element

- Production costs – costs incurred up to stage of goods manufacturing like direct labor, direct material

|

Direct Material Used XXX Direct Labor XXX Direct Expenses XXX Factory Over Head XXX ______ Total Production Cost XXX |

- Non production costs – costs incurred at stage when production of good is completed like selling , distribution costs etc